INDUSTRY ANALYTICS - RETAIL & HOSPITALITY

The Retail & Hospitality sector—accounting for 18.7% of total employment in Philadelphia—includes core industries in retail trade, entertainment, and recreation, as well as accommodation and food services. The sector also includes other industries like movie theaters, rental centers, travel agencies, and janitorial services which are not formally categorized among the core industries but share similar workforce needs.

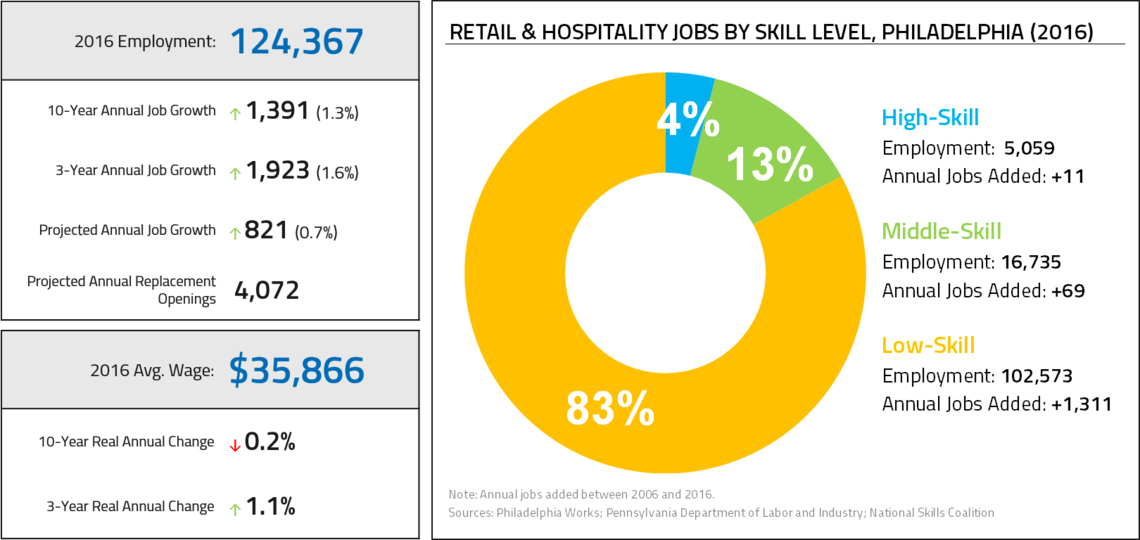

Retail & Hospitality is the second-largest target sector with more than 124,000 jobs in Philadelphia. The sector added the second-largest number of jobs among target sectors during the past decade, averaging 1,400 per year. Job growth accelerated during the past three years, with an average of 1,900 jobs added annually. While the sector has experienced notable job growth, the average salary of $36,000 is the lowest among target sectors. This low average salary is driven by an outsize share of low-skill jobs, which account for 83% of all jobs in the sector. Middle-skill jobs account for just 18% of jobs.

Job growth in the sector has largely been concentrated in hospitality subindustries, with restaurants adding more than 800 jobs annually during the past decade. Growth has been concentrated predominantly in low-skill occupations such as food preparation and serving workers, waiters and waitresses, and restaurant cooks. Supervisor positions account for many of the middle-skill job opportunities in the sector and offer better pay, though there are fewer of these jobs and growth has been slower. On the retail side of the sector, subindustries such as discount department stores and warehouse clubs experienced some growth, but the number of retail sales workers overall declined over the past decade.

- The Retail & Hospitality sector is the second-largest target sector in Philadelphia.

- Employment is heavily concentrated in low-skill jobs—accounting for 83% of sector employment—and 94% of job growth during the past decade was concentrated in low-skill jobs.

- Between 2013 and 2016, employers added an average of 1,900 jobs (1.6%) per year for a total of 5,800 net new jobs.

- Annual employment growth during the past decade (1.3%) outpaced growth in the metro area, state, and nation.

- While the concentration of Retail & Hospitality employment in the metro area is roughly on par with the national rate, the concentration in Philadelphia is lower, though it has risen slightly over the past decade.

- At $35,900, the 2016 mean annual wage for Retail & Hospitality jobs in Philadelphia was higher than the average annual wage for this sector at the metro, state, and national levels, though pay has declined over the past decade.

- Over the past decade wages in Philadelphia dropped by an average of 0.2% per year, but wage growth has picked up more recently—rising by 1.1% annually between 2013 and 2016.

- Despite recent gains in job growth, projections anticipate that sector growth will slow considerably through 2024 to an average of 0.6% per year—less than half the annual average of 1.3% seen between 2006 and 2016.

- Still, projections indicate that approximately 6,600 net new Retail & Hospitality jobs will be created through 2024—or 820 jobs annually, on average.

- The sector has a notably high level of churn—projections estimate 4,072 replacement openings per year through 2024.

- Restaurants account for 28% of sector employment, with Full-Service and Limited-Service Restaurants supporting 34,700 jobs.

- The Restaurants subindustries also added the most jobs in the sector over the past decade, with employment growing by an average of 3%, or 812 net new jobs, per year.

- Most large subindustries expanded during the past decade, with Casinos, Discount Department Stores, and Warehouse Clubs seeing notable growth.

- Select large subindustries, including Hotels, Food Service Contractors, and Family Clothing Stores, experienced notable job loss over the past decade.

- Occupational growth in the Retail & Hospitality sector has occurred largely in Hospitality occupations.

- Nearly 10,000 net new jobs for Food Preparation and Serving Workers, Waiters & Waitresses, Cashiers, and Restaurant Cooks were added over the past decade. These occupations require minimal training, but pay low median wages of around $20,000 per year.

- Supervisor positions in the food industry pay higher wages and require minimal education, but employment growth for these occupations has been slow, with an average of just 70 new jobs created annually since 2006.

- The number of positions for Retail Sales Workers has declined by an average of -0.5%, or 70 jobs per year since 2006. Among the ten largest occupations in this sector, this occupation was the only to see notable job loss over the past decade.