2025 Federal Shutdown - The Economic and Public Impacts on Pennsylvania and Greater Philadelphia region

A federal government shutdown began on October 1, 2025, after Congress missed the fiscal-year budget deadline. Non-essential operations have halted, federally managed landmarks such as Independence Hall and the Liberty Bell Center have closed, and tens of thousands of Pennsylvanians employed by federal agencies now face uncertainty about their pay and their future employment.

Because the Commonwealth’s economy is deeply linked to federal employment, procurement, research, and tourism, the disruption is reverberating through multiple sectors. In this Leading Indicators brief, the Economy League of Greater Philadelphia examines the economic and social consequences of the shutdown for Greater Philadelphia and Pennsylvania, using the latest available data on workforce exposure, program beneficiaries, and economic output.

What You Need to Know

- Scale of exposure: As of July 2025, Pennsylvania hosted roughly 66,700 federal civilian employees and about 101,700 total federal workers when postal and military personnel are included. Roughly 15,000–17,000 civilian staff are employed in Philadelphia alone, primarily in the VA, DHS, and Treasury.

- Economic cost: Each full week of a federal shutdown reduces annualized U.S. GDP growth by about 0.2 percentage point—equivalent to $15 billion in lost national output. Given Pennsylvania’s $1,024 billion GDP—3.5 percent of the U.S. total—that translates to roughly $523 million in weekly state-level losses.

- Workforce and program dependency: More than 1.9 million Pennsylvanians, including 475,000 in Philadelphia, rely on the Supplemental Nutrition Assistance Program (SNAP); another 182,000 statewide depend on WIC.

- Sectoral sensitivity: Roughly $45 billion of Pennsylvania’s GDP is concentrated in federally exposed industries—defense manufacturing, higher education and research, health care, and tourism.

- Tourism hit: Independence National Historical Park welcomed 2.798 million visitors in 2024. With roughly 17 percent of that traffic concentrated in Autumn, a two-week closure could erase $7–$12 million in local visitor spending.

A Deeper Dive

This brief is organized into three sections: Economic Impacts, Public Service Disruptions, and Scenario Outlooks. Together, they trace how the October 2025 federal shutdown is reverberating across Pennsylvania’s economy and essential public systems, and what the trajectory could look like if the impasse persists. Importantly, these analyses must be understood in the context of the discussion on the Management and Budget Circular (MCB) memorandum on October 6, in which federal leadership stated that agencies are not obliged to provide retroactive salary coverage for the shutdown period. This clarification marks a significant departure from precedent and raises the stakes for both furloughed federal workers and the regional economy that depends on their income.

Economic Impacts

1. Federal Workforce and Income Loss

The immediate impact of the shutdown is felt by the 66,656 civilian employees (Sept 12, 2025) across Pennsylvania now working unpaid or placed on furlough. Including military and postal workers, more than 101,700 residents face some form of income disruption. In Philadelphia County, about 15,000–17,000 federal workers—employed largely by the Departments of Veterans Affairs, Homeland Security, and Treasury—are affected.

Lost paychecks directly reduce local purchasing power. The CBO estimates that every week of shutdown trims national GDP by roughly 0.2 point. Applying this to Pennsylvania’s share of GDP implies $523 million per week in foregone output, concentrated in metropolitan service economies. Even though most employees eventually receive back pay, deferred spending on food, retail, and services can never be fully recovered. The 2018–2019 shutdown, which lasted 35 days, cut $11 billion from national output, of which $3 billion was permanently lost.

2. Contractors, Defense, and Business Liquidity

Federal procurement plays a major role in Pennsylvania’s economy. In FY 2024 the Commonwealth received $14.8 billion in Department of Defense contract obligations, supporting an estimated 46,000 private-sector defense jobs. The Philadelphia region accounted for $6.2 billion of those awards, primarily linked to Boeing’s Ridley Park facility, Lockheed Martin, and NAVSEA operations at the Navy Yard.

Payments to these contractors have paused, threatening cash-flow strain if the shutdown endures beyond one billing cycle. Smaller subcontractors with limited reserves could be forced into layoffs. The Pennsylvania Chamber of Business and Industry has also warned that frozen permitting and stalled federal funding jeopardize infrastructure improvements and public-safety projects statewide.

“When you submit invoices during a shutdown, … If nobody is home to process the invoice, it can be challenging to get paid, which can create cash-flow issues, particularly for small businesses.”

- Aron Beezley, co-leader of the Government Contracts Practice Group at Bradley

3. Healthcare, Research and Higher Education Exposure

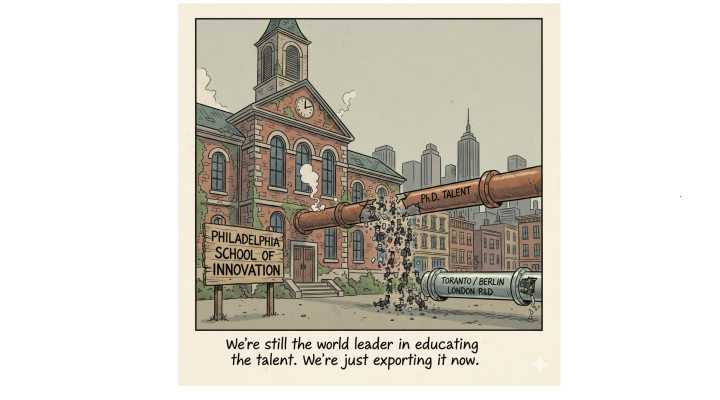

Pennsylvania’s universities and hospitals received over $2 billion in NIH grants in FY 2024—over $1.1 billion of which went to Philadelphia institutions—and another $330 million in NSF awards, including $74 million by University of Pennsylvania. A four-week funding halt could delay payroll or procurement for thousands of research personnel supported by active grants. Penn itself supports over 5,000 researchers. The current estimates based on previous cuts is not available, hence its critical to note that this number could be on the higher side.

Major employers such as the University of Pennsylvania, Drexel University, and Temple University can temporarily cover salaries from reserve funds, but prolonged interruptions are likely to slow research schedules, delay clinical trials, and stall recruitment. The FDA has also furloughed large portions of its review staff, extending approval timelines for pharmaceutical products manufactured in the region.

Another impact is on public health monitoring and emergency preparedness. The Centers for Disease Control and Prevention (CDC) have a regional presence and partnerships in Pennsylvania — while the CDC continues some vital activities, other health programs (like certain disease surveillance or grant-funded community health initiatives) may be scaled back. For example, a program in Philadelphia that relies on a CDC grant to combat opioid overdoses might not receive support during the shutdown.

The pharmaceutical industry in the Philadelphia suburbs — home to Merck, GlaxoSmithKline, and others — also experiences indirect effects. The Food and Drug Administration (FDA) typically has to furlough a portion of its staff, which slows down drug approval processes and clinical trial reviews. If an area company was awaiting FDA approval for a new therapy or conducting FDA-monitored trials, those timelines will slip. Over weeks, this can have commercial ramifications and delay potentially life-saving treatments.

On the healthcare delivery side, as noted earlier, community clinics could face funding uncertainty, and veterans’ healthcare, while funded in advance, could become strained if a lot of administrative staff are furloughed. Claims processing for VA benefits is one area that might slow down.

4. Farming, Consumer Confidence and Local Spending

In 2019, the University of Michigan’s Consumer Sentiment Index dropped 7.7 points—the sharpest fall since 2012. This fall has been attributed to the partial shutdown in 2019, as well as concerns around trade conversations administered by the then administration. A similar decline today would correspond to a reduction of roughly $7-8 million in monthly retail spending (guesstimate) in Pennsylvania, given current income patterns, and the contribution of the consumer packed goods economy for the state at $111.8 billion in 2024. Such sentiment shifts, combined with constrained household cash flow, compound the macroeconomic drag of furloughs.

In Pennsylvania’s rural counties, farmers and small towns also face vulnerabilities, often severe in some cases, and with the potential to have multiplier effects for the next cycle/season. The U.S. Department of Agriculture’s local offices (Farm Service Agency) has 14 offices in the state and managed active loans worth $47 million in 2024. These offices are largely closed, meaning farmers cannot apply for farm loans, commodity support programs, or even get aid if there’s a weather disaster. The shutdown hit right in the middle of the fall harvest season for crops like apples and corn in PA. If farmers need USDA marketing loans or payments, they have to wait – which could hurt their cash flow and ability to pay their own bills. Moreover, rural homeowners seeking USDA rural housing loans are stuck as the USDA halted new direct and guaranteed home loans during the shutdown. This could derail home sales in rural Pennsylvania and prevent families from moving into new homes. According to the National Association of Realtors, about 1,400 real estate transactions per day are at risk nationally due to the inability to get federal loan guarantees or flood insurance during the shutdown. Some of those are undoubtedly in Pennsylvania – especially in areas where buyers depend on VA loans (which are slightly delayed but mostly operational) or USDA loans (on hold entirely). At a national level, the USDA was in the process of issuing the last round of payments to farmers from the $10 billion Emergency Commodity Assistance Program, a one-time economic assistance payment to some commodity farmers, just a few days before the shutdown.

5. Tourism and Hospitality

Tourism represents one of Philadelphia’s most federally sensitive industries. Independence National Historical Park’s 2.798 million visitors in 2024 contributed an estimated $282 million to the area's economy in 2023. With autumn accounting for about 20 percent of yearly visits, a shutdown lasting one month would cost the economy an approx. $18–$20 million (guesstimates). Hotels, restaurants, and tour companies clustered around the historic district are reporting cancellations, while visitors reroute to private museums and attractions that remain open.

At Philadelphia International Airport, roughly 902 aviation employees—including FAA and TSA staff, and ~18,421 full time badged staff—are essential to daily operations. If furlough rates mirror prior shutdowns (30–35 percent nationally), about 270 local workers could be temporarily off duty, risking delays and reduced throughput should the lapse persist. In transportation, training of new air traffic controllers would stop (exacerbating the existing shortage), and maintenance scheduling could get disrupted. If TSA agents quit and replacements can’t be trained or hired during the shutdown, airport security lines could become unmanageably long, or some checkpoints might close, leading to flight cancellations. In late January 2019, staffing shortages at air traffic control centers caused significant flight delays, which was a tipping point that helped end that shutdown.

Public Service Disruptions

- Nutrition and Safety-Net Programs

The Pennsylvania Department of Human Services reported 1.97 million SNAP recipients statewide by May 2025, including ~500,000 in Philadelphia alone. October benefits have been distributed, but the program can operate only through November without new appropriations. The WIC program, serving 185,642 statewide (including 60,886 in the Greater Philadelphia region within PA - Bucks, Chester, Montgomery, Philadelphia, Delaware), relies almost entirely on federal funds; contingency reserves are expected to cover just a few weeks. During the 2018–2019 shutdown, similar programs issued early benefits to bridge gaps, but that option may not be sustainable again.

Historically, states have been able to operate SNAP programs for at least 30 days, one month after a shutdown occurs, so we believe that SNAP will continue in October. However, should a shutdown extend past October into November, SNAP benefits may be at risk,"

2. Housing and Homelessness

According to HUD PIC data (2024), about 78,325 Pennsylvania households hold Housing Vouchers, including 20,879 (as on July 2025) issued by the PHA. These payments total roughly $87 million per month statewide (guesstimates using $1,111 per month housing costs times number of vouchers). A missed monthly disbursement would interrupt transfers to nearly 18,000 landlords. Public housing authorities currently rely on carry-over funds, but if the shutdown extends into November, voucher payments, inspections, and new lease processing could stall.

3. Transportation and Infrastructure

The Pennsylvania Department of Transportation and SEPTA continue operations using state and local funding, but federal reimbursements for capital projects are frozen. About 11,000 FAA employees nationwide—safety inspectors and support staff—are furloughed, while locally, roughly one-third of PHL’s federal aviation workforce could be affected. Extended gaps risk postponing maintenance schedules and delaying new construction bids. The furloughs and funding freezes have raised concerns that maintenance schedules, safety inspections, and new construction/modernization projects could be postponed or delayed during extended shutdowns, potentially causing long-term operational backlogs. If TSA agents quit and replacements can’t be trained or hired during the shutdown, airport security lines could become unmanageably long, or some checkpoints might close, leading to flight cancellations. Indeed, in late January 2019, staffing shortages at air traffic control centers caused significant flight delays, which was a tipping point that helped end that shutdown. We could see a similar effect this time: PHL and other airports might reach a breaking point, pressuring leaders to resolve the funding lapse.

4. Education and Child Care

K–12 public schools remain open, but federal program funds such as Title I, IDEA, and school-meal reimbursements may be delayed after several weeks. October is also the renewal period for many Head Start grants; while most centers in Pennsylvania have sufficient carry-over funds, one program in Jefferson and Clarion Counties has already warned of potential cuts.

5. Courts and Legal Services

The federal judiciary can operate for approximately two weeks on fee revenue. If the lapse continues, civil cases will be stayed, and staff furloughs will begin. Legal-aid organizations like Community Legal Services of Philadelphia are reporting stalled cases tied to unresponsive federal agencies.

Short-Term and Prolonged Scenarios

A short-term shutdown—lasting up to two weeks—would be disruptive but largely reversible. Federal employees would miss one paycheck at most, SNAP funding would remain intact, and research or infrastructure projects could resume quickly once appropriations pass.

As a shutdown wears on, more and more government functions degrade. By week 4 or 5, many agencies will have run out of any carryover funds. That’s when things like routine safety inspections cease entirely – for example, the FDA in past shutdowns halted regular food inspections after a few weeks (which could increase risk of foodborne illness), and the USDA stopped new farm checks.

A prolonged shutdown of four weeks or more, however, would have durable effects. Applying the 2018–2019 CBO ratio suggests that of roughly $11 billion in national losses then, $3 billion (27 percent) was never recovered. For Pennsylvania, whose GDP equals 3.5 percent of the U.S. total, that equates to several hundred million dollars in unrecoverable output if the 2025 shutdown continues into November. Extended lapses would interrupt SNAP and WIC payments, halt Section 8 rent transfers, and exhaust the state’s stopgap resources.

A long shutdown will also begin to hit private sector projects and investments that rely on federal partnership. For example, real estate developers needing approvals from HUD or the EPA or Army Corps might miss critical windows, potentially killing projects or incurring large costs. Tech and biotech companies awaiting patents or FDA drug approvals will face uncertainty that could deter investors. Over several months, the cumulative impact could even affect state tax revenues (less economic activity means less income and sales tax collected), which in turn squeezes state services – a feedback loop of negativity.

In a prolonged scenario, we also must consider psychological fatigue and political pressure. Public frustration tends to mount exponentially after a few weeks, as more people feel the effects and news stories of hardship multiply. This can shift the political calculus, sometimes forcing a resolution, but if it doesn’t, the damage to trust in government can linger. For Pennsylvania, a state with key elections, an extended shutdown could also become a major political issue, but that’s beyond the scope of this analysis.

Consumer confidence would deteriorate further; a 7-point drop similar to 2019 would imply $150 million less monthly retail spending in the state. Prolonged furloughs could also accelerate attrition from federal service and threaten Pennsylvania’s share of federal employment.

Scenario Snapshot

| Sector | Short-Term Outlook | Extended Risk |

|---|---|---|

| Nutrition Assistance (SNAP/WIC) | October benefits disbursed; contingency funds available briefly. | SNAP at risk by November; WIC could exhaust funds within weeks—impacting 80,000+ PA mothers and children. |

| Housing & Homelessness | HUD payments continue from reserves; emergency maintenance ongoing. | Voucher delays and paused inspections risk evictions; homelessness programs face grant interruptions. |

| Transit & Infrastructure | SEPTA and PennDOT continue operations on existing allocations. | Federal grant reimbursements delayed; project approvals frozen. |

| Education & Research | K–12 operations stable; colleges draw on institutional reserves. | Title I and IDEA reimbursements delayed; halted research funding slows projects and hiring. |

| Courts & Legal Aid | Judiciary operates on fees for ~2 weeks. | Civil cases stall; legal-aid backlogs rise as agencies stay unresponsive. |

The Bottom Line

While the economic impacts are substantial, it is equally important to recognize that the shutdown arises from genuine points of policy contestation and unresolved appropriations negotiations. If resolved quickly, the 2025 shutdown will likely register as a temporary disruption; however, each additional week imposes hundreds of millions of dollars in costs on Pennsylvania (on the order of $523 million per week using the White House's estimates) and heightens pressure on households, small businesses, and public institutions. A prolonged lapse risks not only permanent output losses but also a broader erosion of trust in the federal systems that underpin much of the Commonwealth’s economic life.