How New Federal Immigration Policies and Practices Are Impacting Small Businesses in Greater Philadelphia

Since January 2025, sweeping changes in federal immigration policy and practice have had a deep impact on communities and the economy. Tightened border access, ramped up enforcement, mass deportation, and record fees imposed on legal immigration programs have begun reshaping small business operations, labor availability, and consumer behavior across the nation.

In this Leading Indicators brief, the Economy League of Greater Philadelphia examines how the new restrictions are reverberating through small businesses in Pennsylvania and the Philadelphia region—disrupting local labor markets, driving up costs, and dampening growth in communities long fueled by immigrant entrepreneurs and workers.

What You Need to Know

- Policy shock: In the first 100 days after January 2025, more than 180 immigration-related executive actions reversed prior policies—suspending asylum processing, terminating humanitarian parole programs, and expanding deportations.

- Legal immigration costs surge: A new presidential proclamation imposes a $100,000 annual fee for H-1B work visa applications from individuals outside the country (up from $215), potentially pricing small businesses out of sponsoring skilled foreign talent.

- Workforce contraction: Roughly 532,000 people who held legal work authorization under humanitarian parole programs (from Cuba, Haiti, Nicaragua, and Venezuela) lost status in mid-2025, forcing abrupt job exits nationwide.

- Philadelphia exposure: Immigrants make up nearly 20% of the city’s labor force and contribute about 23% of local business income and tax revenue. By summer 2025, local businesses reported vacancies, wage spikes, and declining customer traffic in immigrant-dense neighborhoods.

- Economic drag: Nationally, the immigrant workforce shrank by over 1 million workers by June 2025—a trend translating into tighter labor markets, higher prices, and slower business formation across metro regions.

A Deeper Dive

Labor Disruptions and Workforce Fear

The most immediate impact of the 2025 policy shift was a shock to the labor supply. With parole terminations and heightened enforcement, many immigrant workers in Philadelphia lost legal status or withdrew from the formal economy out of fear of detention. Employers across construction, food service, healthcare, and hospitality sectors suddenly faced vacancies they struggled to fill.

The Federal Reserve Bank of Philadelphia noted that local firms were “looking to fill positions that were recently vacated owing to changes in employees’ visa status.” Restaurants, contractors, and small manufacturers reported absenteeism as immigrant workers left jobs abruptly or avoided commuting altogether. A local restaurateur described the chilling effect: “When people see a police car, they think it’s ICE… The word spreads—don’t go out today.”

Philadelphia’s long-standing “welcoming city” status – which by many measures has been the key driver of population growth in the past 30 years – offered limited reassurance; high-profile arrests in nearby counties deepened anxiety across immigrant neighborhoods, curbing both workforce participation and consumer activity.

Small Business Strain and Consumer Slowdown

In South and Northeast Philadelphia—home to many immigrants and immigrant-owned businesses—foot traffic dropped sharply after the policy rollout. Families curtailed spending, avoided public outings, and held off on discretionary purchases.

The Federal Reserve’s Beige Book documented similar declines in other immigrant-heavy metros, noting that “small business owners reported lower demand and strained finances” as customers stayed home. Philadelphia entrepreneurs mirrored this trend: restaurants shortened hours, groceries reported slower weekdays, and immigrant-owned shops tapped savings to survive the slump.

Wage Pressures and Rising Costs

The crackdown has driven upward wage pressure in several industries. With fewer available workers, employers in construction, hospitality, and cleaning services have had to raise wages by 10–20% to compete for scarce labor.

The Federal Reserve’s October 2025 Beige Book confirmed “strong wage growth” in immigrant-reliant sectors, while the IMF described the immigration pullback as a “negative supply shock” adding to inflationary pressure. Fed Chair Jerome Powell echoed that view, noting that the labor market remained tight “due to the decline in the labor force, with a lower share among immigrants.”

Immigrant Entrepreneurs Under Pressure

Immigrants have long been a cornerstone of Philadelphia’s business ecosystem—owning roughly 30% of small businesses and starting new ventures at twice their share of the population. That pipeline is now at risk.

With visa restrictions tightening and work permits harder to obtain, new immigrant entrepreneurship has slowed. The Welcoming Center and Pew Charitable Trusts warn that immigrants have “single-handedly stemmed the tide of depopulation” in Philadelphia; losing that momentum could erode neighborhood vitality and the city’s business tax base.

Sectoral Impacts

- Construction and Housing: Immigrants accounted for over 75% of the growth in Philadelphia’s construction employment from 2010–2022. Their sudden decline has delayed homebuilding, driven up labor costs, and slowed renovation projects across the region.

- Healthcare and Home Care: Refugees and immigrant aides form a major share of home healthcare workers serving Pennsylvania’s aging population. Deportations and visa lapses have deepened staffing shortages, forcing agencies to turn away clients or reduce coverage.

- Hospitality and Food Service: From Center City hotels to small eateries, staff shortages are widespread. Employers report paying overtime, raising prices, or closing on additional days—mirroring trends seen during prior labor crunches but intensified by policy-driven worker loss.

- Agriculture and Food Supply: Surrounding counties (like Chester, the country’s “mushroom capital”) face seasonal labor shortages as enforcement expands. Nationally, the Labor Department itself acknowledged that “qualified U.S. workers will not make themselves available in sufficient numbers,” warning of risks to food production and pricing.

Long-Term Outlook

The longer these restrictions persist, the more they may reshape Philadelphia’s economic trajectory. Immigrants have been the primary engine of the city’s recent population stabilization and business renewal; without them, workforce growth could stall, entrepreneurship could slow, and neighborhood recovery may falter.

Pew data show that immigrants contributed one-third of Philadelphia’s job growth over the last decade and about a quarter of all business income. A sustained reduction in immigration threatens that foundation. Already, the national foreign-born labor force share had dropped from 20% to 19%, equating to 750,000 fewer workers by June 2025—the first such decline in decades.

The Bottom Line

Philadelphia’s small businesses are navigating a difficult new reality: fewer available workers, higher costs, and declining consumer confidence in immigrant communities. The economic costs of the 2025 immigration crackdown are mounting—tightening labor markets, slowing business formation, and constraining the city’s growth potential.

Scenario Snapshot

| Sector | Short-Term (2025) | Extended Impact (2026 and Beyond) |

|---|---|---|

| Labor Markets | Worker shortages; wage hikes in construction and hospitality. | Persistent gaps; firms automate or relocate; slower job creation. |

| Small Business | Revenue declines in immigrant neighborhoods; compliance burden. | Fewer start-ups; succession issues as owners retire; local tax base erodes. |

| Housing & Construction | Delayed projects; 10–15% cost increase. | Chronic labor deficit → slower housing supply growth → higher prices. |

| Health Care & Elder Care | Staffing shortages in home care agencies. | Rising care costs; facility closures or reduced services for seniors. |

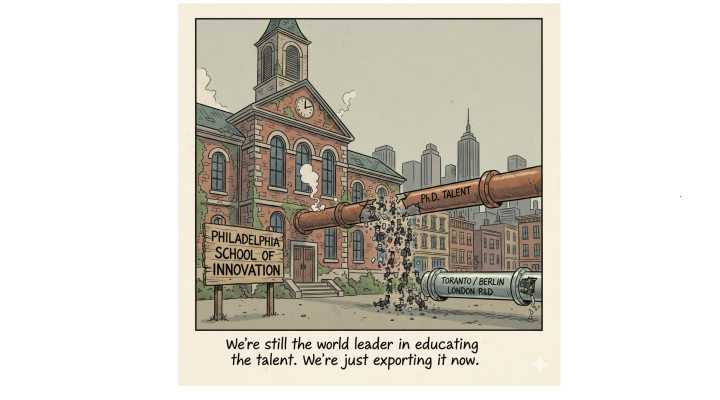

| Higher Education & Innovation | Visa uncertainty for foreign students and researchers. | Reduced talent pipeline; potential loss of R&D investment to other countries. |

Join the Philadelphia Business Immigration Study

The Economy League of Greater Philadelphia is conducting a citywide study to understand how recent immigration policy changes are affecting small businesses — from staffing and compliance costs to customer demand and overall confidence. Your participation will help shape data-driven solutions and policy recommendations that strengthen our local business community.

The survey takes about 10–12 minutes, is completely confidential, and available in multiple languages. Businesses completing the survey will receive a brief summary of citywide findings and may opt in for future follow-ups.

👉 Take the survey and make your voice count in shaping Philadelphia’s economic future.

Note: Quotes are from articles, reports (secondary research, and not primary).